We are a Team of Tax and Transfer Pricing Professionals led by competent and experienced Ex-Big4 and Ex-IRS Team Members.

We offer Professional Services in the areas of Corporate Tax (including M & A Tax), International Tax, Tax Treaty Matters, Transfer Pricing, GAAR, FEMA and Valuations. In these areas we undertake planning, transaction structuring, arm’s length benchmarking, compliance, representation before Tax Authorities and Appeal Litigation, including arguing cases before Dispute Resolution Panel (DRP), ITAT and Authority for Advance Rulings.

These are uncertain times; these are exciting times. We are stepping out of the Old; we are stepping into the New The path of taxation, a path on which we walk with undying enthusiasm, is bending ahead. Beyond the bend lies the new world of taxation, a world inhabited by BEPS, MLI, POEM and GAAR. Of these, GAAR truly is intimidating, standing – sternly – in the way of tax planning, compelling us to instil an element of caution in all our tax planning ventures. Unless we equip ourselves to deal with the challenges posed by GAAR, unless we understand how GAAR affects tax planning, we will not succeed in serving those who, with such reverence, rely on us to take care of their tax matters. Our tradition of service urges us to ponder: how do we achieve tax-efficiency in the era of GAAR?

Read more...

Commodity transactions, both exports and imports, are quite common between Associated Enterprises (AEs).

These transactions have one distinct feature: the prices are quoted in public on reputed Commodity

Exchanges (e.g. London Metal Exchange, Chicago Board of Trade, Multi Commodity Exchange of India,

Malaysian Palm Oil Board,etc.) and published by reputed Price Reporting Agencies (PRAs – like World Oil,

Argus, Platts, Bloomberg,etc). Data of independent third party transactions, therefore, is available in plenty in

the form of price-quotes, on exchanges and in reports of PRAs.

Consider this case. An Indian E-Commerce Company (say, India E-Com Ltd.) partly develops valuable Intangible (unique software to conduct and manage online retail business) for e-commerce, through in-house R & D. India E-Com Ltd. transfers the partly-developed software to its Ireland Subsidiary for a lump sum consideration. The intangible in the form of partly-developed software is hard-to-value. That is because of these reasons

Read more...

Commodity transactions, both exports and imports, are quite common between Associated Enterprises (AEs).

These transactions have one distinct feature: the prices are quoted in public on reputed Commodity

Exchanges (e.g. London Metal Exchange, Chicago Board of Trade, Multi Commodity Exchange of India,

Malaysian Palm Oil Board,etc.) and published by reputed Price Reporting Agencies (PRAs – like World Oil,

Argus, Platts, Bloomberg,etc). Data of independent third party transactions, therefore, is available in plenty in

the form of price-quotes, on exchanges and in reports of PRAs.

These are uncertain times; these are exciting times. We are stepping out of the Old; we are stepping into the New. The path of taxation, a path on which we walk with undying enthusiasm, is bending ahead. Beyond the bend lies the new world of taxation, a world inhabited by BEPS, MLI, PoEM and GAAR. Of these, the GAAR truly is intimidating, standing – sternly – in the way of tax planning, compelling us to instill an element of caution in all our tax planning ventures. Unless we equip ourselves to deal with the challenges posed by GAAR, unless we understand how GAAR affects tax planning, we will not succeed in serving those who, with such reverence, rely on us to take care of their tax matters.

Read more...

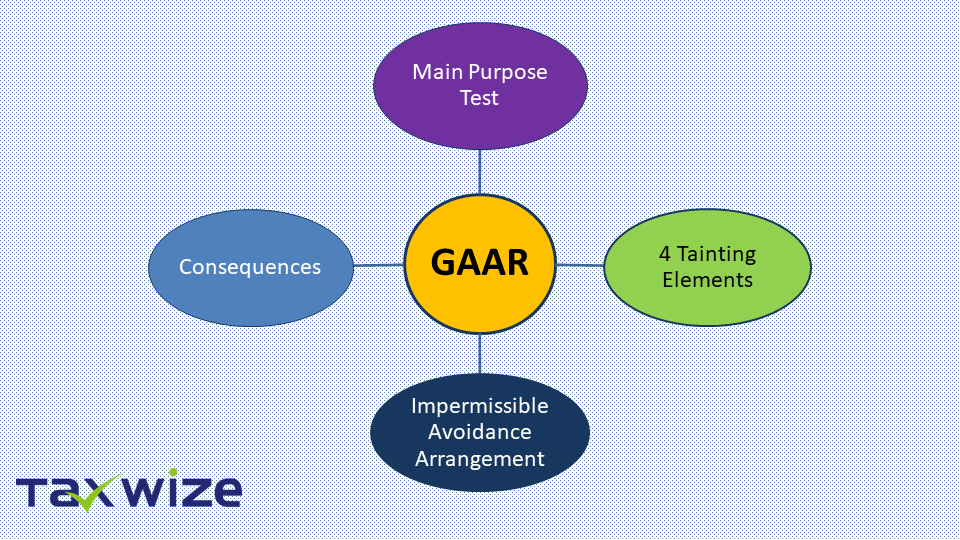

Imagine you have arranged loan for your Company, and the Tax Authorities determine (please see Para 4 below for situations in which the Authorities may do so) that the loan-arrangement is not permissible under General Anti-Avoidance Rule (GAAR). What are the consequences? The Assessing Officer is granted authority (Sec. 98 of Income Tax Act 1961) to re-characterise the Loan (Debt) as Equity and can, by virtue of that authority, re-characterise Interest paid by your Company as Dividend payout. As a result, the deduction for interest payment will be disallowed; instead Dividend Distribution Tax (DDT) will be levied as if dividend – not interest – is paid by your Company. At the same time – unfortunately – the interest income booked by the Lender will not be reduced from the Lender’s taxable income. Why? Because there is no specific provision enabling compensating adjustment and the CBDT has clarified through Circular dated 27th January 2017 that no compensating (or corresponding) adjustments will be granted in GAAR cases.

Read more...